Is Common Stock an Asset or Liability on a Balance Sheet? The Motley Fool

These ratios include the debt-to-equity ratio, current ratio, and return on equity. These ratios can help you understand a company’s financial health and its ability to meet its financial obligations. Finally, it’s worth noting that the balance sheet typically represents a company’s financial position at the end of a calendar year.

Difference Between Preference Share & Equity Share

Common stock is a financial asset because it is a non-physical contract that confers an equity ownership stake in a company. However, because of how they differ from common stock, investors need a different approach when investing in them. Both common stock and preferred stock have pros and cons for investors to consider. The first-ever common stock was issued in 1602 by the Dutch East India Company and traded on the Amsterdam Stock Exchange. The shareholders equity ratio, or “equity ratio”, is a method to ensure the amount of leverage used to fund the operations of a company is reasonable. When companies issue shares of equity, the value recorded on the books is the par value (i.e. the face value) of the total outstanding shares (i.e. that have not been repurchased).

Potential for high returns

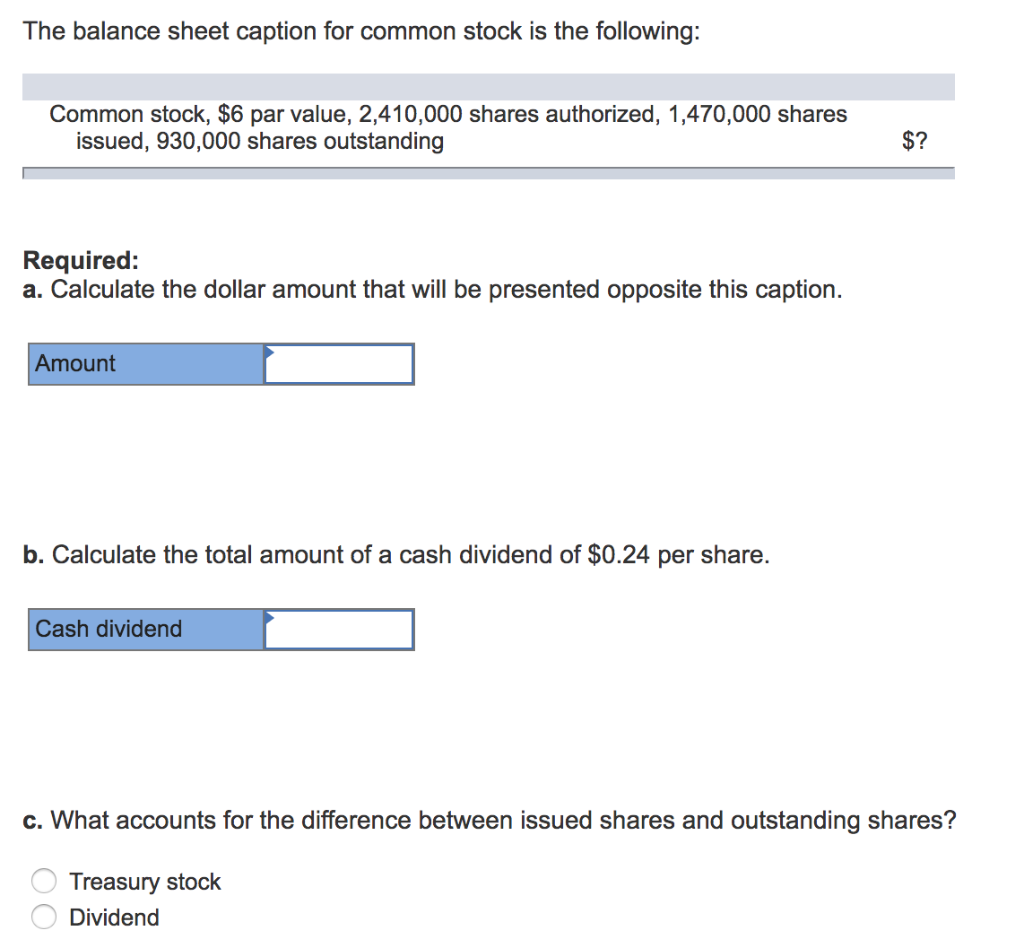

Each investor paid $10 per share in excess of the stated value, and $10 in excess of par multiplied by 1,000 shares outstanding equals $10,000. The $10,000 additional paid-in capital and the $5,000 stated value added together, equals the total value of shares outstanding of $15,000. The first step in calculating common stock on the balance sheet is to determine the total par value of the common stock.

Pros and Cons of Preferred Stock

- If all the company’s assets were converted into cash and all its liabilities were paid off, you would receive 10% of the cash generated from the sale.

- However, some states allow corporations to issue shares with no par value.

- The balance sheet equation must always be in balance, meaning that the total value of a company’s assets must equal the total value of its liabilities and equity.

- The common stockholder has an ownership interest in the corporation; it is not a creditor or lender.

This is where investors can determine the book value, or net worth, of their shares, which is equal to the company’s assets minus its liabilities. It simply represents the amount of value due to common stockholders divided by the number of outstanding common shares. how to pay your credit card bill from another bank with steps The call price of preferred stock is the amount paid to buy out preferred stockholders. This acquisition of funds through the sales of common stocks will need to be recorded in a balance sheet in order to measure and keep track of the company’s finances.

Most ordinary common shares come with one vote per share, granting shareholders the right to vote on corporate actions, often conducted at company shareholder meeting. If you cannot attend, you can cast your vote by proxy, where a third party will vote on your behalf. The most important votes are taken on issues like the company engaging in a merger or acquisition, whom to elect to the board of directors, or whether to approve stock splits or dividends. When people think about investing in a company, common stock is a big deal. Let’s dive into how common stock plays a huge role in making investment choices, focusing on dividends, voting rights, and its value in financial reports.

Provides Transparency

Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

The common stock calculation on the balance sheet is used to determine the book value of the company’s common stock. This information is used by investors to help determine the fair market value of the company and its common stock. In accounting and finance, capital stock represents the value of a company’s shares that are held by outside investors.

It is calculated by multiplying the par value of those shares by the number of shares outstanding. If a company obtains authorization to raise $5 million and its stock has a par value of $1, it may issue and sell up to 5 million shares of stock. The difference between the par value and the sale price of the stock is logged under shareholders’ equity as additional paid-in capital. The section above discusses shareholders’ equity and its role in financing a company’s business plans.

The calculation of common stock is also important for determining the voting rights of shareholders. Each share of common stock represents one vote in corporate elections, such as the election of directors. The number of shares outstanding and the total amount of common stock provide important information about the voting rights of shareholders.

If you’re interested in learning about common stock, you may also in learning about the best broker available for your needs, so visit our broker center to discover the possibilities. Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet. Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations.

This investor will get $100 (1,000 shares X $0.10) in dividends if the company announces a $0.10 per share dividend. The information includes the number of authorized shares and the maximum amount of shares the company can issue. By issuing securities or reducing ownership stakes, the money was obtained. On the other hand, the transaction’s credit impact is reflected in the equity balance. These are amounts owed by a company that will not be due for at least one year from the date of the balance sheet. Dividend yield tells you how much money a company gives to its shareholders.