Actual Hours Managerial Accounting Vocab, Definition, Explanations Fiveable

Restaurant labor management software can help calculate this variance accurately throughout each shift, allowing managers to make informed decisions about staffing. Time tracking can help tell the difference between projects that can be billed and tasks that can’t be billed. Also, businesses that manage their use of billable hours well can increase their total hours worked.

Sporting events, labor, and the importance of earned hours

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

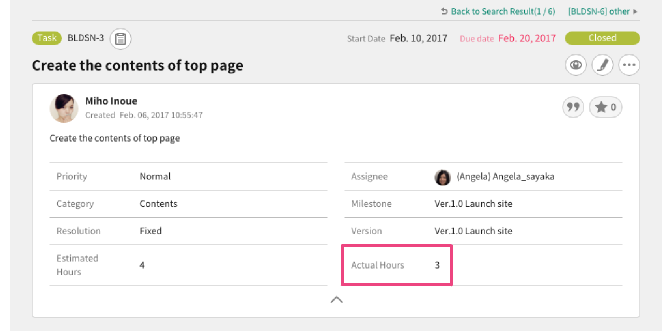

- Hence, variance arises due to the difference between actual time worked and the total hours that should have been worked.

- They’re designed to ensure financial compensation for any time spent on individual client cases.

- For example, excessive hours spent on research might indicate the need to delegate preliminary research tasks to paralegals or junior staff.

- They include time spent doing administrative work and other tasks that the client can’t directly be billed for.

Now that we’ve explained the meaning of billable hours, let’s take a look at a few examples. They’re designed to ensure financial compensation for any time spent on individual client cases. The bill, in most cases, must, therefore, be paid by the client themself.

What is the Difference Between Billable Hours vs Actual Hours?

There’s a common misunderstanding about the difference between hours worked for clients (billable hours) and other work (non-billable overhead). This requires dividing the total revenue you aim to generate by the total billable hours spent on a project. Billable utilization is calculated by dividing the number of billable hours by the total number of working hours available, then multiplying by 100 to get a percentage. Billable hours are the time spent working on tasks directly related to client projects that will be invoiced for. Lawyers rely on billable hours to charge clients for legal services, like research, meetings, and court appearances. Using a time tracking tool to invoice clients based on tracked hours solves these issues.

Our Team Will Connect You With a Vetted, Trusted Professional

The other two variances that are generally computed for direct labor cost are the direct labor efficiency variance and direct labor yield variance. Don’t waste time manually tracking billable and non-billable hours. Non-billable hours can be used for business 8 smart ways to use your income tax refund development activities, such as networking and research, which can lead to long-term growth and success for the company and its employees. One of the major advantages of using billable hours is the clarity and transparency it provides when billing clients.

Considerations for overtime and breaks

Tracking non-billable hours gives you a complete picture of where your time goes. With that information, you can identify areas for improvement and increase your billable utilization over time. Monitoring non-billable hours can help companies manage resources more efficiently and ensure employees spend appropriate time on billable (revenue-generating) work. After tracking your time, Workstatus lets you quickly create client invoices based on your worked hours. Businesses can save time, increase billing accuracy, and improve profits by tracking billable, non-billable, and total hours worked.

Billable

In response to sales conditions throughout the day, managers should make adjustments to their staffing levels. By analyzing your restaurants’ earned hours, you can see how well your managers are making adjustments and help them drive better schedule planning, execution, and reaction in the future. Focusing on your primary goals will allow you to build more confidence and reliability. To run an efficient workplace, it is mandatory to focus on ensuring that your staff is deployed effectively.

By understanding how these things relate, one can improve billing methods and business revenue. Effective management of these hours is key, and many legal professionals leverage technology to keep accurate records and analyze their work distribution. All tasks do not require equally skilled workers; some tasks are more complicated and require more experienced workers than others. This general fact should be kept in mind while assigning tasks to available work force.

The utilization rate calculates billable time as a percentage of an employee’s total working hours. In other words, the utilization rate is a metric of overall productivity. It’s calculated by dividing the total billable hours by the total hours available and then multiplying by 100. When you’re able to view accurate data about your employees’ time, you’ll be able to see whether or not you’re billing for more hours than the amount you’re spending. Actual hours, on the other hand, are all the hours that an employee spends working rather than the hours that can be billed for. So, actual hours encompass both billable hours and non-billable hours.

While it may not all be physically working, any time an employee has to be at their job site counts as hours worked. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

This improves productivity and focuses more on work that makes money. Using time tracking software like Toggl can greatly improve billing practices and make sure billing is correct. By keeping a close eye on hours worked for clients versus other work, you can make your team’s productivity better and focus on work that makes money. To figure out billable hours, you need a good system for tracking time. This system records the total hours worked on projects that can be billed.